There is a strange tension in modern life that almost everyone feels but few can articulate.

We are more technologically capable than at any point in history, yet life feels harder. We are more productive, yet less secure. We are told we live in the most advanced economy ever built, yet the basics — housing, family formation, time — feel increasingly out of reach.

This is not an accident.

And it is not a mystery.

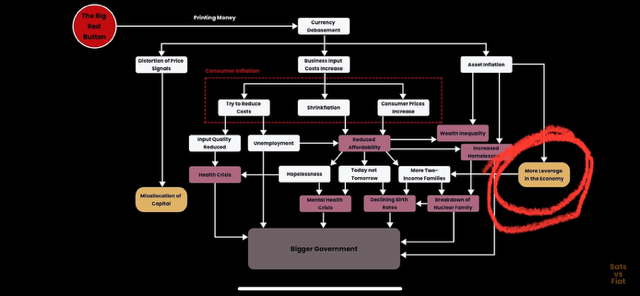

At the centre of it all is inflation — not as a statistic, but as a moral force.

Inflation Is Not Just Rising Prices

Inflation is usually described as a technical necessity, a modest side effect of a complex system. That framing is misleading.

Inflation is the debasement of money over time. It is the erosion of stored effort. It is what happens when money no longer faithfully represents the work that produced it.

When prices rise faster than wages, life becomes more expensive in time. You must work more hours to buy the same future. That is not a neutral outcome. It is a transfer — from savers to debtors, from workers to asset holders, from the future to the present.

Inflation allows governments to run permanent deficits without immediate consequences. It is politically convenient precisely because its damage is delayed, dispersed, and difficult to trace.

That delay is the problem.

Money Is a Proxy for Time

Money is not wealth in itself. It is stored human time.

When you work and save, you are deferring consumption — banking hours of your life for later. When money is debased, that stored time decays. The work still happened. The time was still spent. But its ability to carry forward into the future has been reduced.

This is why inflation is so corrosive. It doesn’t just make things more expensive — it breaks the promise between effort and reward.

And once that promise breaks, trust breaks with it.

The Confusion Around Deflation

At this point, someone usually objects: “But deflation is dangerous.”

This is where language obscures reality.

There are two very different things that get called deflation.

One is demand collapse inside a debt-saturated system, where falling prices make fixed debts harder to service. That is genuinely destructive — but it is a symptom of structural fragility, not a law of nature.

The other is productivity-driven deflation — the cheapening of goods and services through efficiency, technology, and innovation.

This second kind of deflation is not only benign, it is the entire story of human progress.

From tools to agriculture, from industry to software, civilisation advanced by making essentials cheaper in human time. We learned to do more with less. Life became easier because we got better at producing what we needed.

If technology improves and productivity rises, yet prices must still increase for the system to function, then something is wrong. The gains of progress are being intercepted before they reach ordinary people.

That interception is inflation.

Deflation is only considered “dangerous” because our current system cannot tolerate honest prices without collapsing under its own debt.

That is not an argument against deflation.

It is an indictment of the system.

The Shape of the Dystopia

The dystopia people fear is not a dramatic collapse. It is far quieter than that.

It is:

smaller homes longer working hours delayed families permanent insecurity lowered expectations presented as realism

There is no moment where things “break.” There is only gradual acceptance that life should cost more and deliver less.

This is why the damage is so difficult to resist. It arrives disguised as normality.

And it is why inflation is not merely an economic issue. It is an ethical one.

A society that systematically makes the future worse than the past — by design, not by accident — is failing a basic moral test.

What Bitcoin Actually Is (and Isn’t)

Bitcoin is often framed as an investment, a speculative asset, or a political statement. None of those descriptions are precise enough.

Bitcoin is best understood as a monetary refusal.

It refuses:

monetary expansion by decree debasement to cover deficits trust in authority as a prerequisite for saving

Bitcoin does not promise prosperity. It does not guarantee fairness. It does not fix every structural problem.

What it does is simpler — and more radical.

It restores money as stored time.

No committee can dilute it. No emergency can override it. No future promise can quietly borrow against it.

That is not ideology. It is constraint, encoded.

Can Bitcoin Prevent the Dystopia?

No.

A society cannot asset-allocate its way out of moral failure. Bitcoin does not build houses, reform education, or make political systems courageous.

If only a minority adopt it, the broader trajectory can continue unchanged — with inequality simply expressed in a new form.

But Bitcoin can do something important.

It can allow individuals and families to opt out of the mechanism of theft.

How an Individual Uses Bitcoin to Refuse the System

Bitcoin works when it is used boringly.

Not as a trade.

Not as leverage.

Not as a gamble.

But as time preservation.

In practical terms, this means understanding life in layers:

Fiat for survival — bills, food, obligations Bitcoin for savings — long-term, untouched, patient Skills and resilience — because stored time only matters if you can still earn

Debt matters here. Inflation turns debt into servitude. Bitcoin and high leverage do not mix.

Volatility matters too. Bitcoin removes smoothing and manipulation. Price swings are not a flaw — they are the absence of lies. Anyone who cannot tolerate that volatility will sabotage themselves.

Bitcoin does not remove effort. It removes decay.

The Intergenerational Dimension

Bitcoin’s most important feature is not personal gain. It is intergenerational honesty.

It allows people to save without being forced into speculation.

It allows effort to reach the future intact.

It allows children to inherit stored time rather than starting from zero in a system that resets every generation.

That is not utopian. It is modest. And it is profound.

What Bitcoin Will Not Do

Bitcoin will not:

make life easy remove inequality eliminate hardship replace work or meaning

It offers optionality, not comfort.

It amplifies discipline and punishes recklessness. It exposes character rather than compensating for it.

Bitcoin does not save people from themselves.

The Real Question Bitcoin Forces Us to Ask

The most uncomfortable thing about Bitcoin is not its volatility or its politics.

It is the question it makes unavoidable:

Why must money decay for society to function at all?

If we are truly becoming more productive, more capable, more efficient — why must the future always pay more for the same life?

Bitcoin does not answer every question.

But it makes one thing clear:

Inflation is not inevitable.

Debasement is not natural.

And theft does not become moral just because it is slow.

Bitcoin is not a promise of utopia.

It is a refusal to accept quiet decay as the price of modern life.

And sometimes, refusal is where change begins.