“How do I get on the property ladder?”

- It isn’t a ladder.

- It’s an overblown liability (it’s not an asset) — just like a car or a laptop.

The populist idea is that immigration is responsible for house prices rising relative to income, but this isn’t true at all. Immigration has its own problems, but house prices aren’t one of them. The supply of housing has risen at roughly the same rate as the increase in population. The thing responsible for soaring house prices is liquidity. Back in the 1970s, you went to the bank and borrowed 2.5x your yearly income. Today, we’re talking about 5x your income and 50-year mortgages. You’re basically buying two houses for the bank and one for yourself.

Notice how new car prices are crazy now?

I bought a brand-new Vauxhall Vivaro van for £14,000 in 2008.

Now I’d be looking at £40,000.

Why?

Because we buy cars using finance. People are addicted to buying status symbols. They pay through the nose, but it all feels manageable because the showrooms offer finance. Instead of investing in their financial freedom, they pay £400 a month for the car. A better option: buy a 2016 Kia Picanto for £500. It will last 10 years. Put the £400 a month into investments.

Want to know how to fix the housing market tomorrow?

Remove the leverage.

If the government announced that the lending rate was 1.5x income only, the housing market would crash fifty percent overnight.

But nobody wants that.

Champagne socialists.

Everyone is following comrade “tax the rich” Gary Stevenson while voting for more quantitative easing to push up house prices and inflation — which is a tax on the poor. The heroin-addict “property” owners just want the number to keep going up, and they don’t want to fall into negative equity. Never mind the fact that their children and grandchildren will never be able to buy a house. The problem isn’t capitalism. The problem is socialism. Our money isn’t tethered to anything tangible, and endless money printing by a central entity devalues our currency and pushes up the cost of buying a house.

In real terms, houses didn’t go up.

Measured in ounces of gold, house prices are lower now than they were in 1970.

In 1971, we came off the gold standard with the end of the Bretton Woods agreement.

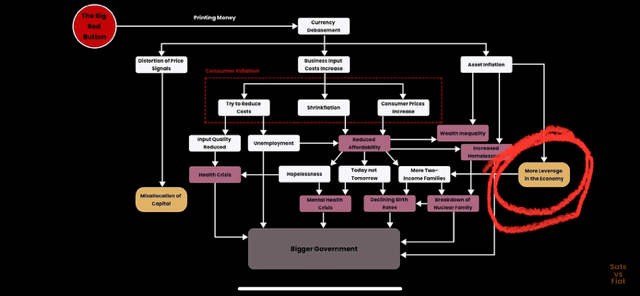

Since the end of the Bretton Woods system, every measure of human existence has gone down the toilet. This is because everyone gets a yearly pay cut as the currency is inflated towards zero, while house, food, and energy costs go through the roof. Two-parent households become a necessity, and the nuclear family breaks down due to stress — leading to worse outcomes for kids, more reliance on benefits, all paid for by the big red button of money printing.

If you want, I can also rewrite this as a tighter, punchier version for social media while keeping the same message.

There’s a way out though.

Bitcoin.

Leave a comment